Source: Fajar Sandhika / Auriga Nusantara, Aerial Photo of PT Industrial Forest Plantation, (1°30’32.84”S – 114°11’12.21”E).

Source: Fajar Sandhika / Auriga Nusantara, Aerial Photo of PT Industrial Forest Plantation, (1°30’32.84”S – 114°11’12.21”E). Indonesian Pulp Exports and Deforestation

Source: Fajar Sandhika / Auriga Nusantara, Aerial Photo of PT Industrial Forest Plantation, (1°30’32.84”S – 114°11’12.21”E).

Source: Fajar Sandhika / Auriga Nusantara, Aerial Photo of PT Industrial Forest Plantation, (1°30’32.84”S – 114°11’12.21”E). By Adelina Chandra, Jason Jon Benedict, Brian Orland and Florian Gollnow

Originally published by trase on December 9, 2025 . Reposted here with permission.

Indonesia’s pulp sector ranks seventh largest in the world and is an important contributor to the national economy, accounting for about 4% of non-oil-and-gas GDP and providing 1.5 million direct and indirect jobs. Six pulp mills on Sumatra source wood from 2.3 million hectares of industrial tree plantations – an area over 30 times the size of Singapore – spread across Sumatra and Kalimantan (see Map). The pulp mills and many of the wood suppliers are owned by three multinational corporate groups; two of them (Royal Golden Eagle and Sinar Mas) control mills that account for 96% of total production.

In 2024, nearly 45% of pulp made in Indonesia was used domestically. The country’s two largest producers operate integrated facilities that manufacture paper, tissue and viscose staple fibre within Indonesia. About 75% of pulp exported in 2024 was shipped to China, where much of it is processed in mills affiliated with Royal Golden Eagle and Sinar Mas (both corporate groups are among China’s leading producers of paper, tissue, packaging and viscose). Pulp produced in Indonesia is also sold to third-party mills in Indonesia, China, India, South Korea, Bangladesh, Vietnam and other countries. While Indonesia does not export pulp directly to the European Union or the United States, finished products made from it, such as paper, tissue, packaging, and textiles, are sold in those markets.

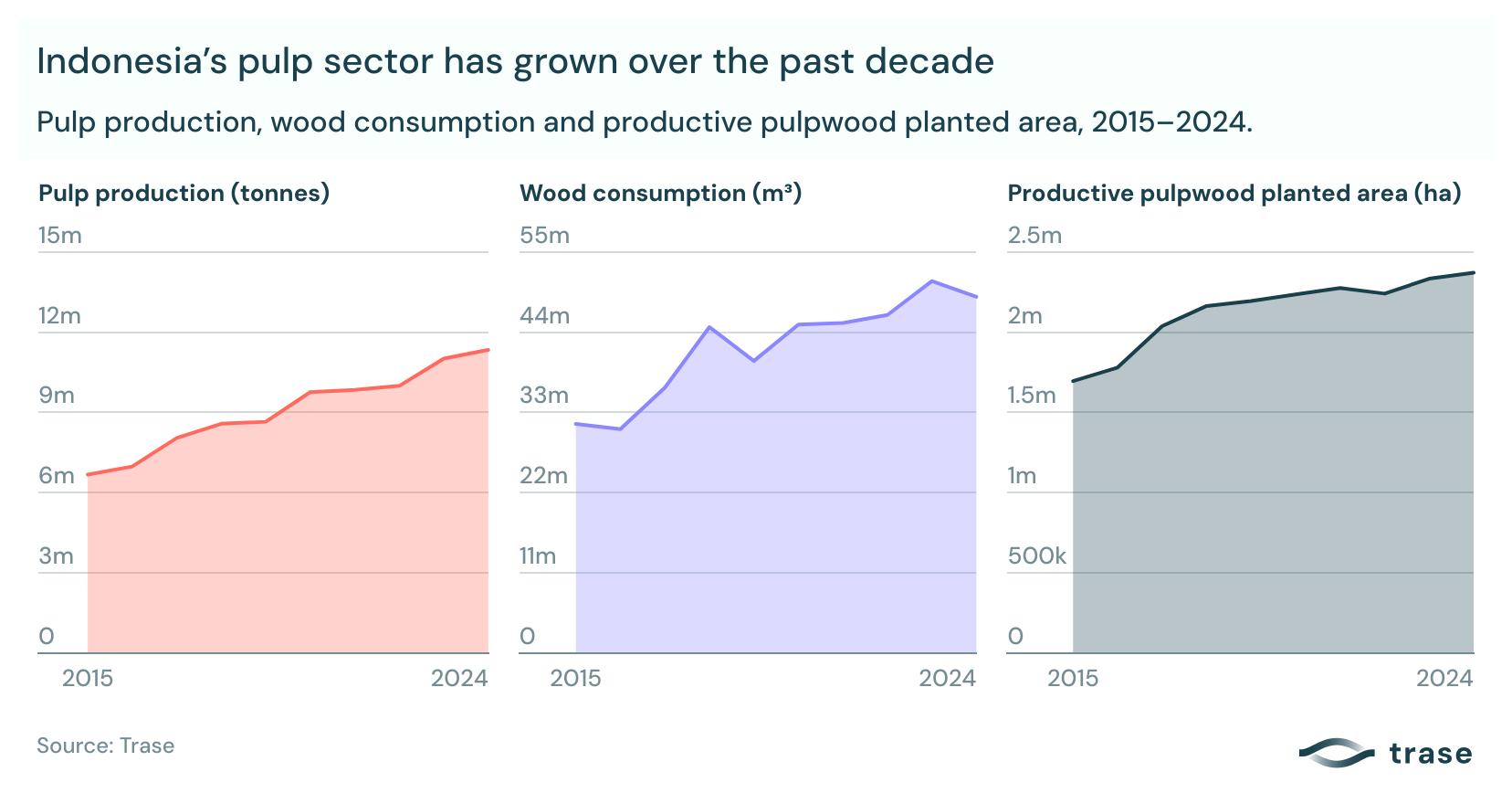

Over the past decade, Indonesia’s pulp sector expanded its production by 70%, from 6.7 million tonnes in 2015 to 11.3 million tonnes in 2024. As pulp production grew, wood consumption in the sector increased by more than 50% over the same period. To meet this demand, the area of industrial plantations – fast-growing acacia and eucalyptus species harvested on four- to five-year cycles – expanded by 40%, from 1.7 million hectares in 2015 to 2.4 million hectares.

Deforestation and pulp production

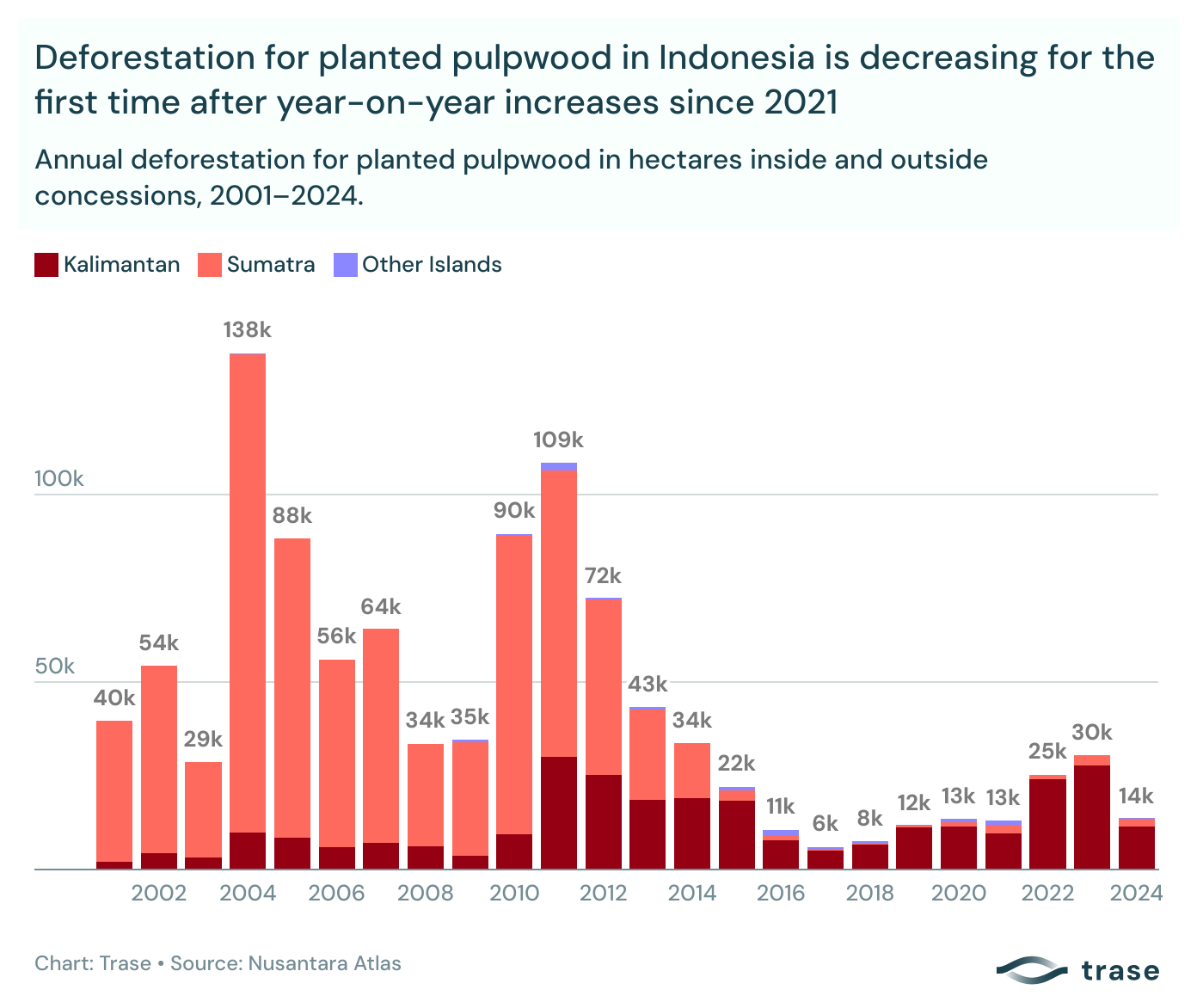

Establishing these plantations came at a high cost to Indonesia’s rainforests. Since 2001, concession holders currently supplying wood to Indonesia’s pulp and chip mills (active suppliers) have cleared a cumulative 740,821 hectares of forest, measured from one year after their licences began. By 2015, when both major producers had adopted zero-deforestation commitments through No Deforestation, No Peat, No Exploitation (NDPE) policies, the majority of forest loss within their suppliers’ concessions had already taken place, largely focused on the provinces of Riau and Jambi on Sumatra.

In 2024, total annual deforestation for industrial pulpwood plantations reached 13,630 hectares, a 55% reduction compared to 30,345 hectares in 2023, and the first decline after year-on-year increases since 2021. This forest loss includes deforestation for timber within all concessions, active and non-active suppliers (concessions not yet supplying wood to pulp or chip mills), as well as deforestation for timber outside those licenced concessions, building on the forest-change data provided by The TreeMap and published in Nusantara Atlas. Most of the deforestation for industrial pulpwood has been in Kalimantan, the Indonesian part of Borneo, with the provinces of West, Central, and East Kalimantan accounting for more than 90% of the deforestation both in the past decade and in the last couple of years.

Markets and traders

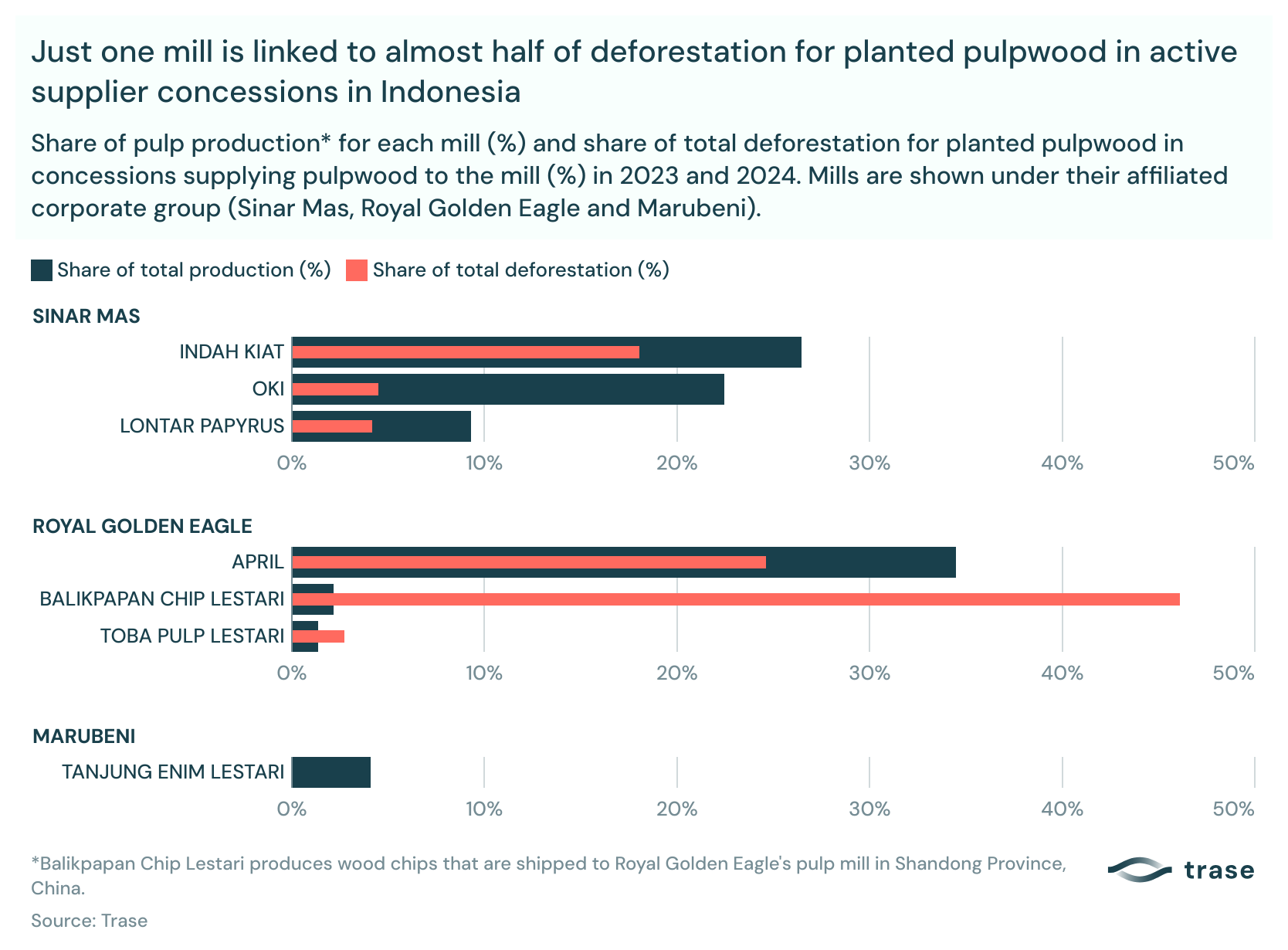

At the corporate group level, Royal Golden Eagle is related to the most annual deforestation in the sector over the past two years (see Figure). The majority of that deforestation is associated with one wood chip mill, Balikpapan Chip Lestari in East Kalimantan, which exclusively supplied wood chips to Royal Golden Eagle’s pulp mill in Shandong, China. In December 2023, Royal Golden Eagle confirmed sourcing wood chips from Balikpapan Chip Lestari and committed to working with the wood chip mill to stop sourcing wood from concessions with recent deforestation. Our analysis indicates that in 2024, the wood chip mill received wood from suppliers with 7,578 ha of deforestation in the preceding five years.

Current pulpwood suppliers to Indonesia’s mills account for only part of the sector’s deforestation footprint. Recent deforestation in the pulp sector was primarily linked to companies that have not yet supplied wood to the mills. For example, in the PT Mayawana Persada concession in West Kalimantan, more than 40,000 hectares of rainforest have been cleared for pulpwood plantations since 2020, including habitat for orangutans, white-bearded gibbons and other protected species. However, since it is not yet supplying wood to any pulp or chip mill, PT Mayawana Persada and its deforestation remain outside the scope of any corporate zero-deforestation policy.

Pulp producers’ zero-deforestation policies apply only to their active wood suppliers, leaving most licensed pulpwood plantation areas outside their scope. In 2024, these active suppliers held concessions covering less than 45% of the 11 million hectares licensed for industrial tree plantations in Indonesia. Yet around 81% (118,030 hectares) of all deforestation between 2015 and 2024 occurred in plantation concessions that are not currently supplying pulpwood to the mills, particularly in Kalimantan.

These potential supplier areas also contain over three-quarters of the remaining natural forest (2.23 million hectares) within areas licensed for industrial plantation development, mainly in Kalimantan and Papua. With a new pulp mill in North Kalimantan starting to operate in 2025, this policy gap poses a significant risk of further forest loss as demand for pulpwood grows. Investigations by the media and environmental groups have linked Royal Golden Eagle to the new Phoenix Resources International mill, but Royal Golden Eagle denied any connection and the new pulp mill is not yet covered under the corporate group’s zero-deforestation policy.

Greenhouse gas emissions

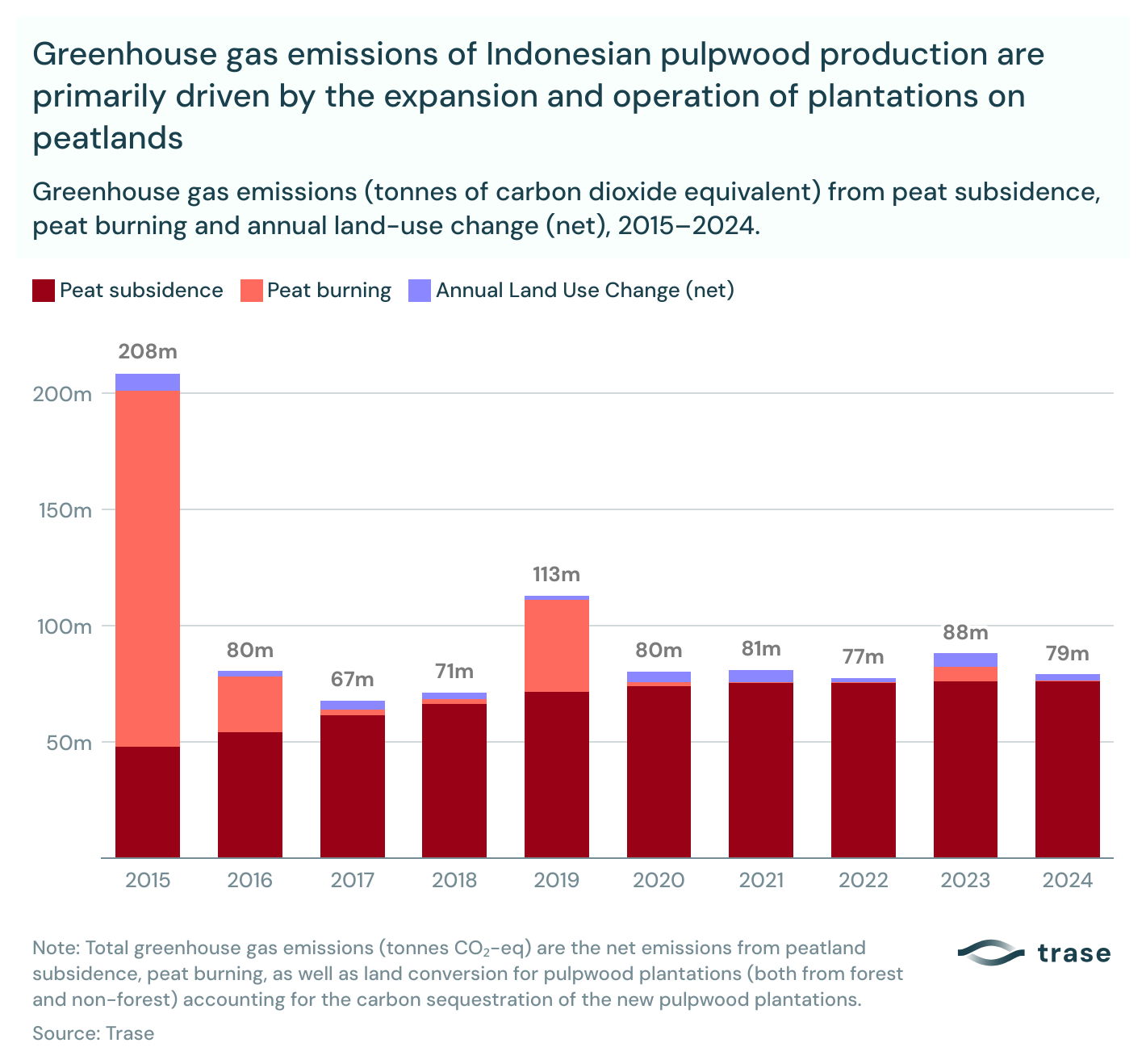

Besides deforestation, another major environmental issue facing Indonesia’s pulp sector are the greenhouse gas (GHG) emissions, largely driven by producers’ reliance on drained peatlands. More than one million hectares of the pulp sector’s plantation base, or about 43%, lies on peatlands. When drained for industrial scale tree farms, peatlands release significant amounts of GHG emissions and are highly vulnerable to uncontrollable fires during prolonged dry periods. The sector’s reliance on drained peatlands became a major political issue in 2015, when uncontrollable fires triggered months of haze across Indonesia, Singapore and Malaysia, causing both a public health crisis and severe economic losses. Nearly 350,000 hectares of pulpwood burned within active supplier concessions, more than half of them on peatlands.

Following the 2015 fire and haze crisis, both major pulp producers pledged to restore and conserve peatlands. Yet our analysis shows that productive pulpwood plantations on peatlands did not significantly decrease, remaining at more than one million hectares in 2024 within active supplier concessions. GHG emissions from peat subsidence – where drained peat compacts and oxidizes, releasing carbon dioxide and other GHGs – was 76 million tonnes CO₂-eq in 2024, or 6% of Indonesia’s national total. Emissions from peat subsidence accounted for 95% of gross emissions from annual land-use change across the sector’s plantation base in 2024, before carbon sequestration from tree growth was factored into net emissions.

Social impacts

Social conflicts linked to the pulp sector persist in Indonesia, with civil society organisations documenting hundreds of conflicts across Sumatra and Kalimantan that impact over a thousand villages. Most recently, members of a North Sumatra community in conflict with PT Toba Pulp Lestari were allegedly attacked by the forestry company’s security forces, leading the Forest Stewardship Council to suspend its Memorandum of Understanding with the company’s corporate parent, Royal Golden Eagle. In 2015, a farmer and activist in Sumatra was allegedly murdered by plantation security staff, and community members have been criminalised and jailed for offences against pulpwood companies affiliated with Indonesia’s pulp mills.

Future sustainability of the pulp sector

In recent years, the sector has sustained steady growth while keeping new deforestation for pulp far below the historically high levels of the 1990s and 2000s. However, growing threats to sector-wide NDPE commitments include a newly operating pulp mill in North Kalimantan, which is much closer than the existing mills in Sumatra to forestry concessions containing the most remaining primary forest in Kalimantan, Sulawesi and Papua. The future sustainability of Indonesia’s pulp sector will hinge on closing gaps in NDPE coverage, restoring degraded peatlands and ensuring that future mill capacity expansions and concessions with significant primary forest are managed without further deforestation.

The authors thank the researchers and data scientists who have contributed to this analysis: Carina Mueller, David Gaveau, Agus Salim, Harry Biddle, Husnayaen Husnayaen, Grahat Nagara, Timer Manurung, Sulih Primara Putra, Clement Suavet, Supintri Yohar, Christopher Barr, and Robert Heilmayr.

Explore and download the Indonesian pulp data at trase.earth

Explore the pulp-driven deforestation at: https://map.nusantara-atlas.org/

To reference the data, please use the citation: Benedict, J., Chandra, A., Orland, B., Gollnow, F., Mueller, C., Gaveau, D., Salim, A., Biddle, H., Husnayaen, H., Nagara, G., Manurung, T., Putra, S. P., Suavet, C., Yohar, S., Barr, C., & Heilmayr, R. (2025). SEI-PCS Indonesia wood pulp supply chain and sustainability metrics (Version 3.2) [Data set]. Trase. https://doi.org/10.48650/RS65-VQ40

A detailed explanation of Trase’s methodology is available at: Trase. (2025). SEI-PCS Indonesia wood pulp v3.2 supply chain map: Data sources and methods. Trase. https://doi.org/10.48650/3CR2-0H45

To reference this article, please use the citation: Chandra, A., Benedict, J. J., Orland, B., & Gollnow, F. (2025). Indonesian pulp exports and deforestation. Trase. https://doi.org/10.48650/G14V-HV28