A native tree left standing in an oil palm plantation in Papua. Ulet Ifansasti/Greenpeace

A native tree left standing in an oil palm plantation in Papua. Ulet Ifansasti/Greenpeace Palm oil deforestation in Indonesia levels off in 2022

A native tree left standing in an oil palm plantation in Papua. Ulet Ifansasti/Greenpeace

A native tree left standing in an oil palm plantation in Papua. Ulet Ifansasti/Greenpeace Analysis by TheTreeMap, conducted using Sentinel-2 and Planet/NICFI satellite imagery

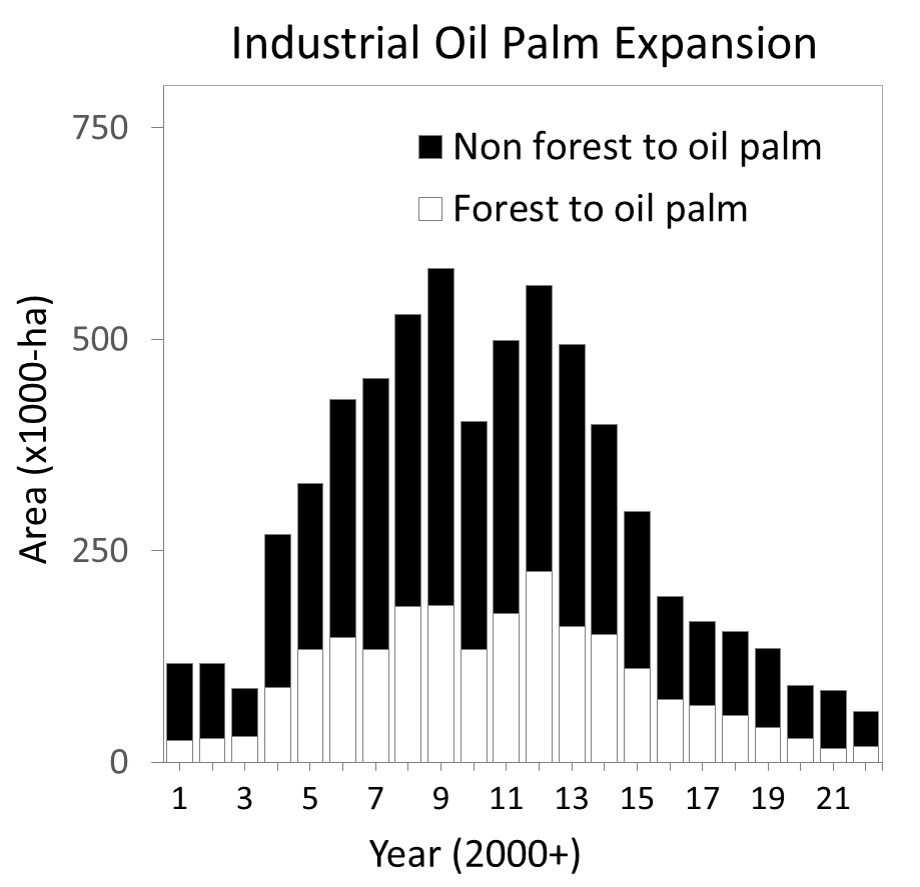

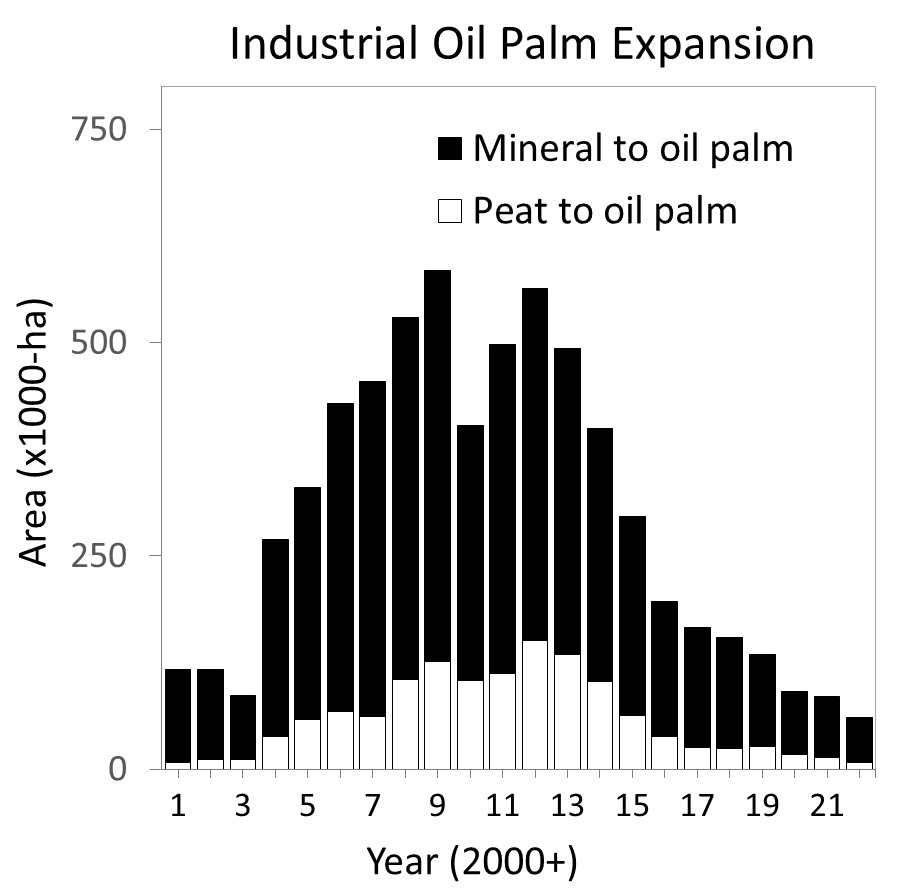

In 2022, Indonesia experienced its second-lowest annual deforestation caused by industrial palm oil production, following a record 22-year low in 2021.

Industrial plantations grew by just 59,965 hectares in 2022, a 29% decrease from the previous year and a 22-year low (2001-2022).

Surprisingly, palm oil-driven deforestation increased 14% from the previous year, with 18,830 hectares of forest converted in 2022 compared to 16,530 hectares cleared in 2021.

The conversion of peatland for palm oil cultivation saw a 41% drop from 2021, with a total of 8,012 hectares cleared compared to 13,617 hectares the previous year. This marks the lowest level of peatland conversion for palm oil since 2002.

This is good news and demonstrates some commitment from the Indonesian government and the monitoring of NDPE commitments.

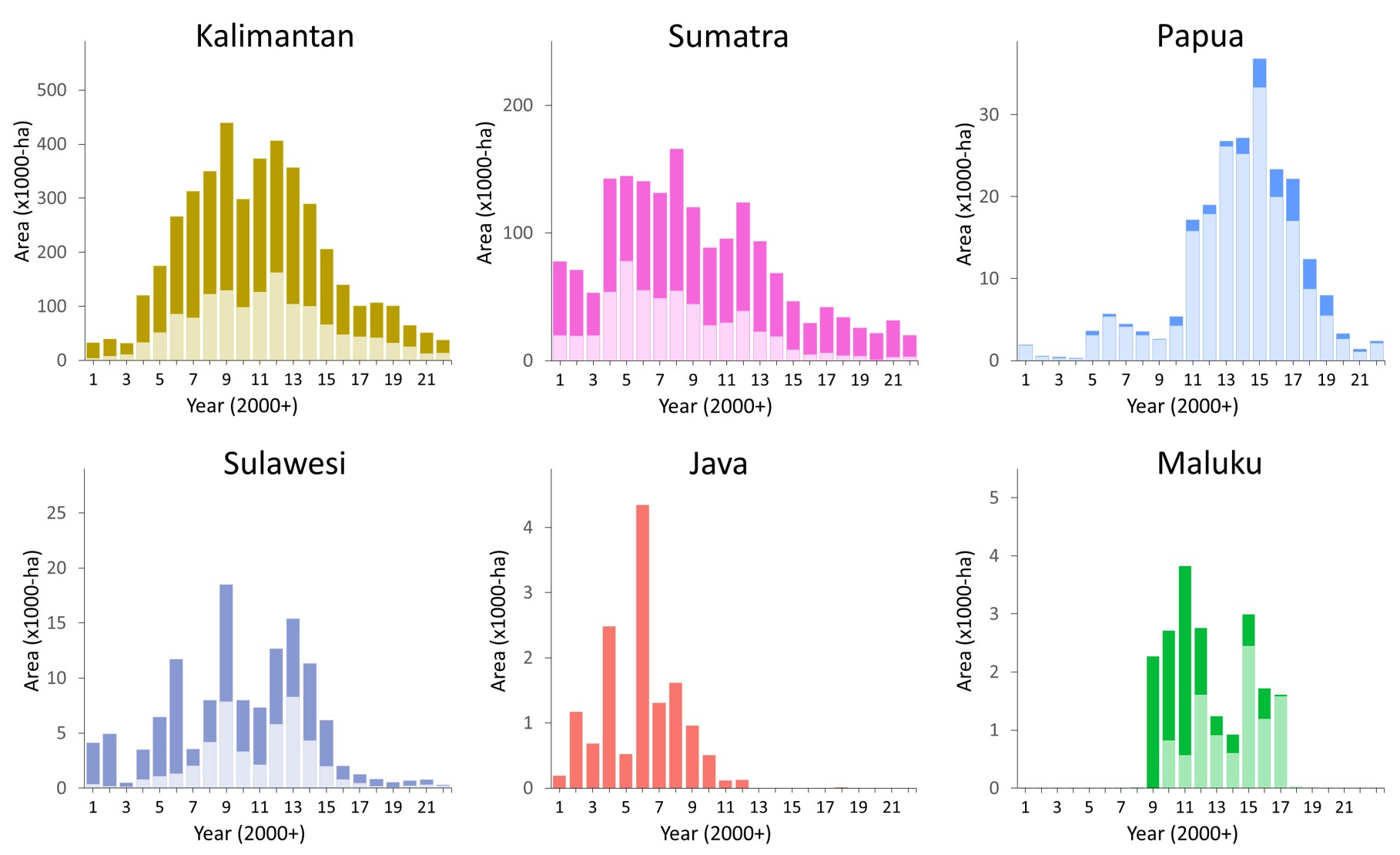

Nevertheless, satellite imagery has shown an increase in deforestation in Papua, the country’s final frontier. Palm oil-driven deforestation declined or stabilized in Kalimantan and Sumatra, but doubled in Papua from the previous year, with 2,123 hectares of primary forest converted. This number remained well below 2015, when the palm oil industry cleared >30,000 ha of forest.

The satellites and cadaster compiled in Nusantara Atlas also reveal that scores of companies still engage in deforestation and peat conversion for oil palm.

In 2022, > 41 companies engaged in deforestation for oil palm, and > 18 exploited peatlands, including on orangutan habitat (e.g. Permata Sawit Mandiri in Kalimantan), despite efforts to prevent deforestation and peat conversion.

Tables 1 and 2 at the end of this document report the complete list of companies converting forest and peatlands to industrial monoculture oil palm in 2022.

PT Permata Sawit Mandiri supplied NDPE markets in 2022 through the mill of the company Goodhope (until the end of January 2022), and Bumitama’s Bukit Belaban Jaya mill in West Kalimantan.

In 2022, Ciliandry Anky Abadi cleared the most forest, 1,894 ha in three separate concessions, including 1,452 ha in a newly acquired concession Inti Kebun Sawit in West Papua. The company is owned by Ciliandry and Wiras Fangiono, part of the wider Fangiono family behind Singapore-based First Resources. First Resources is the subject of a Roundtable on Sustainable Palm Oil (RSPO) complaint due to issues around ownership between Ciliandry Anky Abadi and First Resources and the affiliated FAP Agri. According to CRR, Ciliandry Anky Abadi enters NDPE supply chains through Grupo Bimbo and Mondelēz.

Ciliandry Anky Abadi keep disregarding the law by clearing the ancestral lands of indigenous peoples, even after their permits have been revoked, such as PT Inti Kebun Sawit and PT Permata Nusa Mandiri in Papua.

PT Permata Nusa Mandiri is an oil palm plantation owned by Indonesian businessman Anthoni Salim behind Salim Group, a company group that operates multiple business lines such as oil palm plantations (under Salim Ivomas Pratama and IndoAgri), media, grocery stores.

Indigenous People strongly opposed the development of oil palm in the area managed by PT Permata Nusa Mandiri because land overlaps with the ancestral lands of the Namblong People. On Feb. 28, the Jayapura government ordered the company to halt its forest clearing activities, to no avail.

Despite La Nina weather phenomenon, bringing rain to Indonesia, Large fires >6000 ha linked to palm oil expansion on peatlands still occurred in 2022 near several palm oil mills in West Sumatra supplying to international buyers. The four palm oil processing mills are the Tapan plant, owned by the company Kemilau Permata Sawit, and nearby Sodetan, Silaut and Anak Angkat mills, all owned by Incasi Raya.

Despite genuine and dedicated conservation efforts by Park Offices, deforestation for palm oil accelerated in 2022 in some key protected areas: Tesso Nilo national park in Riau, Rawa Singkil Nature Reserve in Aceh, and the Leuser Ecosystem, the home of orangutans, elephants and Tigers.

A newspaper concluded in July 2021 that PT Mitrasari Prima mill is processing palm oil fruits from Tesso Nilo. MitraSari Prima supplies CPO and PKO to GAR and Musim Mas, and Wilmar.

PT. Nia Yulided Bersaudara continued to decimate lowland rainforests in 2022 northeast of the Leuser Ecosystem in Aceh. The company sold to a mill called PT. Bumi Sama Ganda. PT. Bumi Sama Ganda is listed as a palm oil supplier to Nestlé, Colgate Palmolive, PepsiCo, Nissin Foods and major traders including Wilmar, Golden Agri Resources, Sime Darby, ADM and Bunge Loders Croklaan.

Table 1. List of companies converting forest to industrial monoculture oil palm in 2022. This table only shows conversion >50 ha.

| No | Company Name | Group | Concession (Ha) | Province | Deforestation | ||

| 1 | Inti Kebun Sawit | Ciliandry Anky Abadi | 13,344 | West Papua | 1,452 | ||

| 2 | Pipit Citra Perdana | Other/unknown | 16,531 | North Kalimantan | 1,397 | ||

| 3 | Permata Sawit Mandiri | Sepanjang (formerly Genting) | 16,770 | West Kalimantan | 1,137 | ||

| 4 | Lahan Agro Inti Ketapang | Alam Indah Sdn Bhd/Meadows Capital Ltd | 12,472 | West Kalimantan | 704 | ||

| 5 | Kartika Nugraha Sakti | Bengalon Jaya Lestari | 14,422 | North Kalimantan | 697 | ||

| 6 | USU | Asian Agri Group | 6,769 | North Sumatra | 639 | ||

| 7 | Citra Palma Pertiwi | Sulaidy | 7,877 | East Kalimantan | 556 | ||

| 8 | Khatulistiwa Agro Abadi | First Borneo | 16,868 | West Kalimantan | 500 | ||

| 9 | Anugerah Langkat Makmur | Alam | 18,881 | North Sumatra | 470 | ||

| 10 | Arthatama Prima Persada | Other/unknown | 3,845 | East Kalimantan | 393 | ||

| 11 | Inti Kebun Sejahtera | Ciliandry Anky Abadi (formerly Kayu Lapis Indonesia, Kalia Agro) | 21,885 | West Papua | 342 | ||

| 12 | No name | Bengalon Jaya Lestari | 7,838 | North Kalimantan | 340 | ||

| 13 | Sumber Rahmat Sentosa | Other/unknown | 6,524 | Central Kalimantan | 337 | ||

| 14 | Sawit Rokan Semesta | Other/unknown | 10,108 | Riau | 268 | ||

| 15 | Menthobi Mitra Lestari (PT Menthobi Sawit) | Bakrie | 10,691 | Central Kalimantan | 260 | ||

| 16 | Tridaya Hutan Lestari | Ciliandry Anky Abadi | 2,696 | East Kalimantan | 244 | ||

| 17 | Banyan Tumbuh Lestari | Buana Pratama Cipta (formerly Provident Agro) | 18,720 | Gorontalo | 229 | ||

| 18 | Citra Agro Abadi | Fangiono Family/Ciliandry Anky Abadi (CAA) | 9,199 | Central Kalimantan | 216 | ||

| 19 | Permata Nusa Mandiri | Salim/IndoGunta | 17,396 | Papua | 202 | ||

| 20 | Subur Karunia Raya | Salim/IndoGunta | 38,600 | West Papua | 199 | ||

| 21 | Taringin Perkasa | Other/unknown | 4,821 | Central Kalimantan | 150 | ||

| 22 | Palm Beach Indonesia | Other/unknown | 14,419 | West Kalimantan | 145 | ||

| 23 | Rendi Permata Raya | Other/unknown | 3,740 | North Sumatra | 130 | ||

| 24 | Sebuku Inti Plantation | Central Cipta Murdaya (Murdaya Family) | 4,443 | North Kalimantan | 118 | ||

| 25 | Agrindo Sukses Sejahtera | Starmas Sentosa Mandiri | 5,384 | East Kalimantan | 110 | ||

| 26 | Agrindo Green Lestari | Fangiono Family/Ciliandry Anky Abadi (CAA) | 8,745 | Central Kalimantan | 103 | ||

| 27 | Sawit Berkat Sejahtera | Salim/IndoGunta | 7,123 | North Kalimantan | 100 | ||

| 28 | Senabangun Aneka Pertiwi | Other/unknown | 18,709 | East Kalimantan | 96 | ||

| 29 | Anugerah Niaga Sawindo | Other/unknown | 7,982 | Riau | 93 | ||

| 30 | Mitra Sawit Makmur | Other/unknown | 7,119 | East Kalimantan | 89 | ||

| 31 | Setia Agro Abadi | Sulaidy | 18,118 | East Kalimantan | 84 | ||

| 32 | Menthobi Mitra Lestari | Bakrie | 5,019 | Central Kalimantan | 84 | ||

| 33 | Nabatindo Karya Utama | Bumitama | 9,262 | Central Kalimantan | 84 | ||

| 34 | Bulungan Citra Agro Persada | TSH Resources | 19,320 | North Kalimantan | 82 | ||

| 35 | Sandai Makmur Sawit | Other/unknown | 10,084 | West Kalimantan | 80 | ||

| 36 | Mitrakarya Agroindo | Sinar Mas (GAR) | 22,929 | Central Kalimantan | 79 | ||

| 37 | Tekukur Indah | Kuala Lumpur Kepong (KLK) | 2,906 | East Kalimantan | 67 | ||

| 38 | Borneo Citra Persada Jaya | Sulaidy | 17,927 | East Kalimantan | 65 | ||

| 39 | Nia Yulided Bersaudara | Other/unknown | 2,207 | Aceh | 59 | ||

| 40 | Kahayan Agro Plantation | Anglo Eastern | 14,940 | Central Kalimantan | 59 | ||

| 41 | Flora Nusa Perdana | Other/unknown | 6,371 | Central Kalimantan | 58 | ||

| 42 | Nunukan Jaya Lestari | Sinar Mas (GAR) | 21,382 | North Kalimantan | 56 | ||

| 43 | Ketapang Hijau Lestari | Other/unknown | 13,918 | East Kalimantan | 54 | ||

| 44 | Rana Wastu Kencana | Rana Wastu | 13,372 | West Kalimantan | 52 | ||

| 45 | Tanjung Sawit Abadi | Citra Borneo Indah | 17,503 | Central Kalimantan | 51 |

Table 2. List of companies converting peatlands to industrial monoculture oil palm in 2022. This table only shows conversion >50 ha.

| No | Company Name | Group | Concession (Ha) | Location | Clearing on peat (Ha) | ||

| 1 | Samora Usaha Jaya | Sungai Budi/Tunas Baru Lampung | 40,073 | South Sumatra | 1,702 | ||

| 2 | Pipit Citra Perdana | Other/unknown | 16,531 | North Kalimantan | 1,424 | ||

| 3 | Lahan Agro Inti Ketapang | Other/unknown | 12,472 | West Kalimantan | 811 | ||

| 4 | Kartika Nugraha Sakti | Bengalon Jaya Lestari | 14,422 | North Kalimantan | 703 | ||

| 5 | Khatulistiwa Agro Abadi | First Borneo | 16,868 | West Kalimantan | 621 | ||

| 6 | Tania Binatama | Sampoerna Agro | 5,108 | South Sumatra | 490 | ||

| 7 | Borneo International Anugerah | First Borneo | 20,016 | West Kalimantan | 229 | ||

| 8 | Lestari Alam Raya | Other/unknown | 10,290 | West Kalimantan | 185 | ||

| 9 | Palm Beach Indonesia | Other/unknown | 14,419 | West Kalimantan | 175 | ||

| 10 | Sebuku Inti Plantation | Central Cipta Murdaya (Murdaya Family) | 4,443 | North Kalimantan | 169 | ||

| 11 | Andes Sawit Lestari | Cargill | 15,091 | West Kalimantan | 139 | ||

| 12 | Citra Agro Abadi | Fangiono Family/Ciliandry Anky Abadi (CAA) | 9,199 | Central Kalimantan | 131 | ||

| 13 | Sebakis Inti Lestari | Central Cipta Murdaya (Murdaya Family) | 11,010 | North Kalimantan | 112 | ||

| 14 | USU | Asian Agri Group | 6,769 | North Sumatra | 78 | ||

| 15 | Sungai Rangit Jaya | Sampoerna Agro | 7,765 | Central Kalimantan | 69 | ||

| 16 | Hamparan Sentosa | NPC Resources | 10,274 | East Kalimantan | 62 | ||

| 17 | Ichiko Agro Lestari | Other/unknown | 7,673 | West Kalimantan | 59 | ||

| 18 | Mulia Indah | Musim Mas | 7,860 | West Kalimantan | 43 |

TheTreeMap endeavours to protect tropical forests through scientific research and advanced monitoring platforms. We are cartographers, remote sensing engineers, software developers, and field investigators. We empower civil society with the tools to detect deforestation in real-time and ensure what happens on the ground is fair, transparent, and democratic. We build systems that check the deforestation footprint of agribusinesses in tropical forests to ensure sustainable production. Our work is based on the premise that no one wants food and other products to be the cause of forest destruction.