A man loading a truck with bunches of palm oil fruit in Riau Province, Sumatra.

A man loading a truck with bunches of palm oil fruit in Riau Province, Sumatra. 2023 Marks a Surge in Palm Oil Expansion in Indonesia

A man loading a truck with bunches of palm oil fruit in Riau Province, Sumatra.

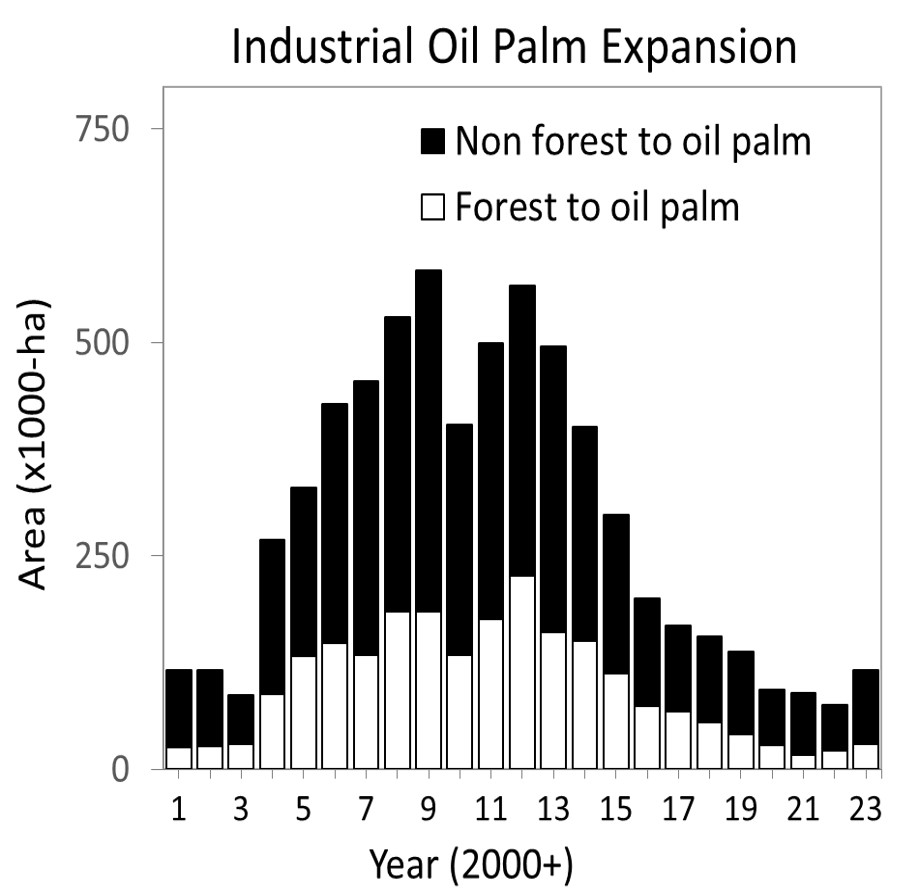

A man loading a truck with bunches of palm oil fruit in Riau Province, Sumatra. In 2023, Indonesia saw an increase in deforestation caused by the expansion of intensively managed industrial monoculture palm oil plantations, following a record 21-year low in 2021 (White bars; Figure 1).

Industrial plantations grew by 116,000 hectares in 2023 (White and black bars; Figure 1), a 54% increase from the previous year. The associated deforestation increased by 36%, with 30,000 hectares of forest converted in 2023 compared to 22,000 hectares cleared in 2022.

Despite this increase, palm oil-driven deforestation remains significantly lower than in 2012, a year that witnessed the conversion of 227,000 hectares of forest to plantations.

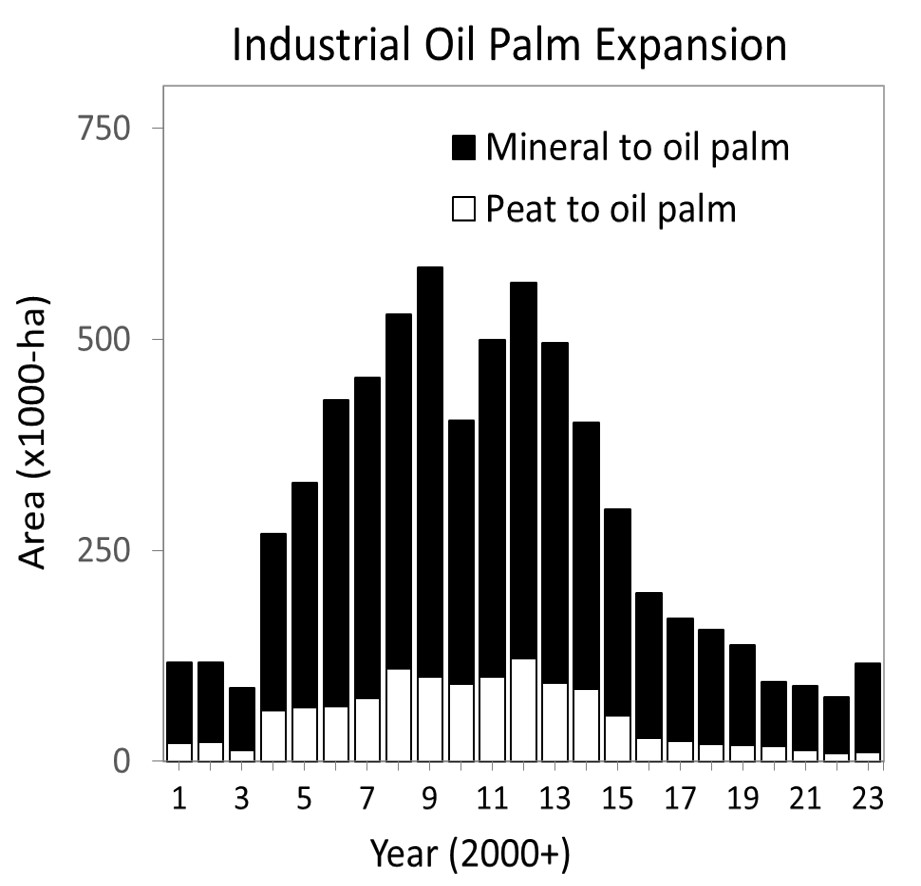

There was a slight uptick in the area of peatlands converted to industrial palm oil, with a total of 10,787 hectares being converted in 2023, a 17% increase from the 9,180 hectares cleared in the preceding year.

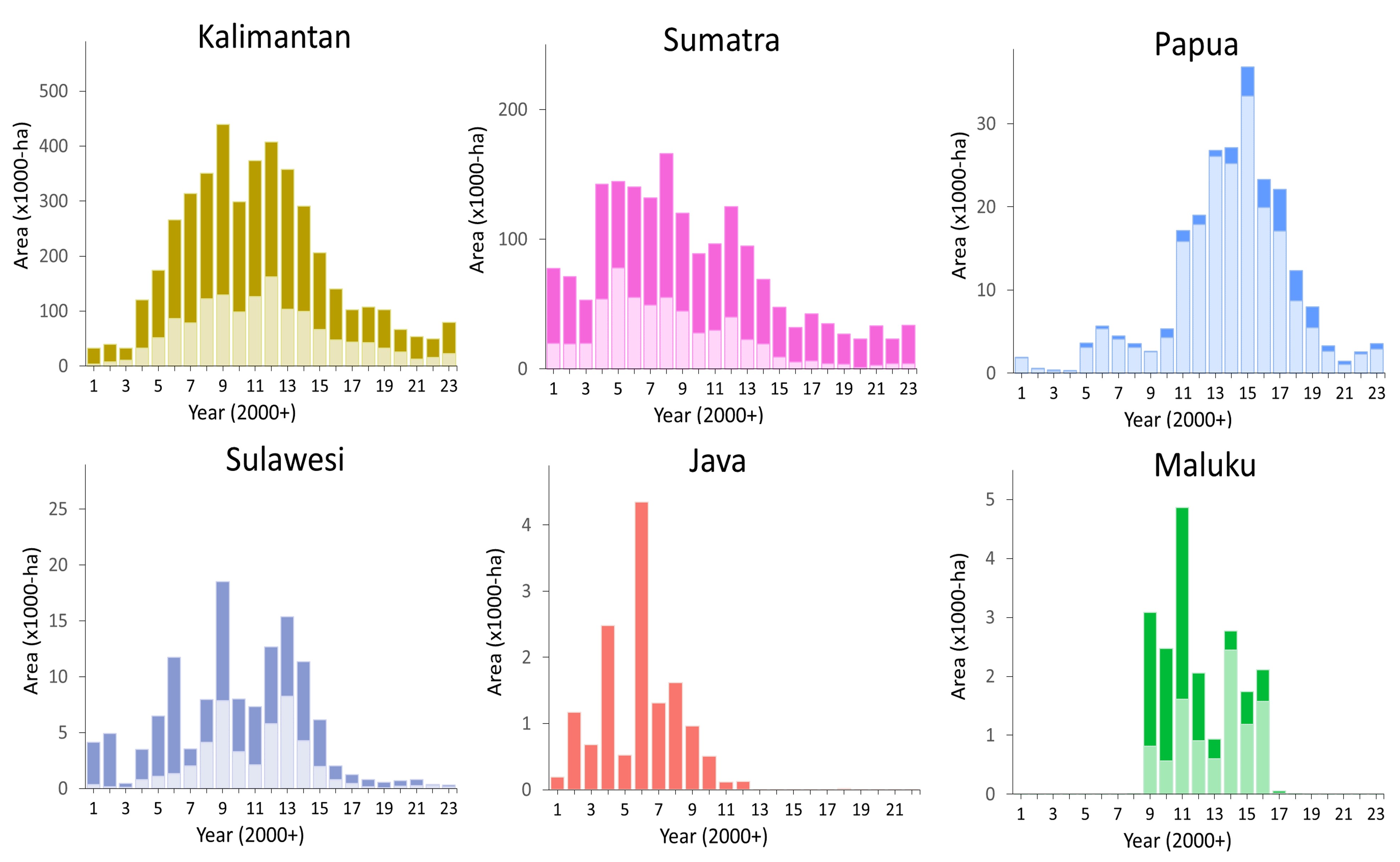

When analyzed regionally, the increase in deforestation due to palm oil expansion (light bars; Figure 3) was most significant in Kalimantan and Papua, with a somewhat lesser rise observed in Sumatra.

The concession dataset developed by Greenpeace and compiled in Nusantara Atlas reveals that scores of companies still engage in deforestation and peat conversion for oil palm.

In 2023, 53 concessions cleared forest (>50 ha) for oil palm, and 20 exploited peatlands, despite efforts to prevent deforestation and peat conversion.

Similar to 2022, the company Ciliandry Anky Abadi led the way in forest clearing in 2023, clearing a total of 2,302 hectares across three distinct subsidiaries. This includes 1,702 hectares in the recently acquired Inti Kebun Sawit concession in West Papua, which was the top contributor to forest destruction for oil palm in both 2023 and 2022.

The “Chasing Shadows” article from The Gecko Project reveals that the Singapore-based First Resources, a major palm oil producer known for marketing its product as ‘sustainable’ and RSPO-certified, is covertly linked to Ciliandry Anky Abadi and Sulaidy. These companies are also implicated in the conversion of forests and peatlands into industrial oil palm plantations in 2023.

First Resources and its affiliated ‘shadow companies’ were responsible for clearing 3,285 hectares of forest in 2023.

The Gecko Project investigation revealed that First Resources utilized “shadow companies” to circumvent sustainability standards while still presenting an image of environmental accountability. Despite a complaint lodged against them in 2021 with the Roundtable on Sustainable Palm Oil (RSPO), the RSPO has not addressed the issue with the seriousness it merits. Consequently, First Resources remains a member of the RSPO to this day.

Among other prominent contributors to forest destruction, Alam Indah Sdn Bhd/Meadows Capital Ltd stands out, having cleared 1,294 hectares of forest, including areas of peatland in its Lahan Agro Inti Ketapang Concession in West Kalimantan. This entity is a registered company based in Malaysia.

Tables 1 and 2 present a comprehensive list of companies involved in converting forests and peatlands into industrial oil palm plantations in 2023. Each of these companies is catalogued in the Nusantara Atlas, where users can view satellite animations to independently verify the changes. Additionally, there is a brief instructional video at the end of this document that guides users on how to create time-lapse visualizations for each listed company.

Table 1. List of companies converting forest to industrial monoculture oil palm in 2023. This table only shows conversion >50 ha.

| No | Company Name | Group | Concession area (Ha) | Province | Palm-oil Deforestation (Ha) | |

| 1 | Inti Kebun Sawit | Ciliandry Anky Abadi/First Resources | 13.344 | West Papua | 1.702 | |

| 2 | Lahan Agro Inti Ketapang | Alam Indah Sdn Bhd/Meadows Capital Ltd | 12.472 | West Kalimantan | 1.294 | |

| 3 | Borneo International Anugerah | First Borneo | 20.016 | West Kalimantan | 930 | |

| 4 | Subur Karunia Raya | Salim/IndoGunta | 38.600 | West Papua | 737 | |

| 5 | Sumber Rahmat Sentosa | Other/unknown | 6.477 | Central Kalimantan | 703 | |

| 6 | Permata Sawit Mandiri | Sepanjang | 16.770 | West Kalimantan | 685 | |

| 7 | Sepalar Yasa Kartika | Other/unknown | 14.960 | Central Kalimantan | 547 | |

| 8 | Prasetya Mitra Muda (Block I) | Other/unknown | 7.493 | Central Kalimantan | 479 | |

| 9 | Khatulistiwa Agro Abadi | First Borneo | 16.868 | West Kalimantan | 384 | |

| 10 | Alam Sari Lestari | Other/unknown | 12.446 | Riau | 384 | |

| 11 | Kaltim Hijau Makmur | CT Agro | 15.157 | East Kalimantan | 368 | |

| 12 | Citra Palma Pertiwi | Sulaidy/First Resources | 7.877 | East Kalimantan | 351 | |

| 13 | Tridaya Hutan Lestari | Ciliandry Anky Abadi/First Resources | 9.588 | East Kalimantan | 326 | |

| 14 | Borneo Citra Persada Jaya | Sulaidy/First Resources | 17.927 | East Kalimantan | 287 | |

| 15 | Inti Kebun Sejahtera | Ciliandry Anky Abadi/First Resources | 21.885 | West Papua | 274 | |

| 16 | Mitra Kapuas Agro | First Borneo | 7.229 | West Kalimantan | 240 | |

| 17 | Palm Beach Indonesia | Other/unknown | 14.419 | West Kalimantan | 197 | |

| 18 | Krida Darma Kahuripan | Makin | 13.508 | Central Kalimantan | 187 | |

| 19 | Mitra Sawit Makmur | Other/unknown | 7.119 | East Kalimantan | 181 | |

| 20 | Usaha Sawit Unggul | Asian Agri/RGE | 6.769 | North Sumatra | 174 | |

| 21 | Banyan Tumbuh Lestari | Buana Pratama Cipta | 18.720 | Gorontalo | 155 | |

| 22 | Arjuna Utama Sawit | Other/unknown | 15.651 | Central Kalimantan | 137 | |

| 23 | Berkah Sawit Abadi | First Borneo | 34.000 | West Kalimantan | 123 | |

| 24 | Citra Permata Serundung | Other/unknown | 8.174 | West Kalimantan | 120 | |

| 25 | Cipta Usaha Sejati | Pasifik Agro Sentosa | 18.039 | West Kalimantan | 118 | |

| 26 | Nabire Baru | Goodhope | 17.612 | Papua | 114 | |

| 27 | Bangun Batara Raya | DTK Opportunity | 2.578 | Central Kalimantan | 113 | |

| 28 | Menthobi Mitra Lestari (PT Menthobi Sawit) | Bakrie | 10.691 | Central Kalimantan | 112 | |

| 29 | Borneo Citra Persada Mandiri | Sulaidy/First Resources | 11.899 | East Kalimantan | 108 | |

| 30 | Indokarya Gema Sakti | Other/unknown | 4.192 | East Kalimantan | 104 | |

| 31 | Kalimantan Hamparan Sawit | Abdi Budi Mulia | 12.034 | Central Kalimantan | 104 | |

| 32 | Kurun Sumber Rejeki | Other/unknown | 9.481 | Central Kalimantan | 102 | |

| 33 | Palmdale Agroasia Makmur | Gozco Plantations | 16.983 | West Kalimantan | 99 | |

| 34 | Wana Catur Jaya Utama | Rajawali/Eagle High | 11.387 | Central Kalimantan | 97 | |

| 35 | Sandai Makmur Sawit | Other/unknown | 10.084 | West Kalimantan | 92 | |

| 36 | Swadaya Mukti Prakarsa | Fangiono Family/First Resources | 21.116 | West Kalimantan | 92 | |

| 37 | Kartika Nugraha Sakti | Bengalon Jaya Lestari | 14.422 | North Kalimantan | 83 | |

| 38 | Tekukur Indah | Kuala Lumpur Kepong (KLK) | 2.906 | East Kalimantan | 80 | |

| 39 | Karya Tama Bakti Mulya | Fangiono Family/First Resources | 6.658 | Riau | 79 | |

| 40 | Watu Gede Utama | Unknown | 6.015 | Aceh | 77 | |

| 41 | Kalimantan Agro Makmur | Unknown | 5.967 | East Kalimantan | 70 | |

| 42 | Gumas Alam Subur | Jhonlin | 10.462 | Central Kalimantan | 67 | |

| 43 | Gerbang Benuaraya | Abdi Budi Mulia | 20.604 | West Kalimantan | 67 | |

| 44 | Brahma Bina Bakti | Rachmat/Triputra | 12.998 | Jambi | 66 | |

| 45 | Borneo Citra Persada Abadi | Sulaidy/First Resources | 14.303 | East Kalimantan | 66 | |

| 46 | Tantahan Panduhup Asi | STA | 11.083 | Central Kalimantan | 65 | |

| 47 | Teladan Palma Perkasa | Unknown | 4.014 | East Kalimantan | 60 | |

| 48 | Senabangun Aneka Pertiwi | Unknown | 18.709 | East Kalimantan | 58 | |

| 49 | Bina Sarana Sawit Utama | Samuel | 26.340 | Central Kalimantan | 56 | |

| 50 | Permata Hijau Sarana | Unknown | 13.664 | West Kalimantan | 55 | |

| 51 | Sawit Desa Makmur | Unknown | 13.571 | Jambi | 55 | |

| 52 | Ruta Jona Lestari | Unknown | 20.729 | Central Kalimantan | 55 | |

| 53 | Permata Nusa Mandiri | Salim/IndoGunta | 17.396 | Papua | 53 | |

| 54 | Katingan Hijau Lestari | Unknown | 9.526 | Central Kalimantan | 52 |

Table 2. List of companies converting peatlands to industrial monoculture oil palm in 2022. This table only shows conversion >50 ha.

| No | Company Name | Group | Concession (Ha) | Location | Clearing on peat (Ha) | ||

| 1 | Samora Usaha Jaya | Sungai Budi/Tunas Baru Lampung | 40.073 | South Sumatra | 1.110 | ||

| 2 | Borneo International Anugerah | First Borneo | 20.016 | West Kalimantan | 999 | ||

| 3 | Alam Sari Lestari | Unknown | 12.446 | Riau | 671 | ||

| 4 | Lahan Agro Inti Ketapang | Alam Indah Sdn Bhd/Meadows Capital Ltd | 12.472 | West Kalimantan | 596 | ||

| 5 | Gading Cempaka Graha | Unknown | 5.385 | South Sumatra | 584 | ||

| 6 | Arjuna Utama Sawit | Unknown | 15.651 | Central Kalimantan | 335 | ||

| 7 | Gerbang Benuaraya | Abdi Budi Mulia | 20.604 | West Kalimantan | 191 | ||

| 8 | Palm Beach Indonesia | Unknown | 14.419 | West Kalimantan | 189 | ||

| 9 | Uniseraya | Uniseraya | 8.692 | Riau | 188 | ||

| 10 | Borneo Sawit Perdana | Unknown | 10.814 | Central Kalimantan | 136 | ||

| 11 | Palmdale Agroasia Makmur | Gozco Plantations | 16.983 | West Kalimantan | 133 | ||

| 12 | Kartika Nugraha Sakti | Bengalon Jaya Lestari | 14.422 | North Kalimantan | 124 | ||

| 13 | Tani Swadaya Perdana | Unknown | 4.270 | Riau | 116 | ||

| 14 | Sumber Sawit Sejahtera | Unknown | 2.891 | Riau | 113 | ||

| 15 | Wana Subur Sawit Indah | Unknown | 5.699 | Riau | 83 | ||

| 16 | Menteng Kencana Mas | Citra Borneo Indah | 19.876 | Central Kalimantan | 77 | ||

| 17 | Sinar Dinamika Kapuas | Lyman | 58.018 | West Kalimantan | 71 | ||

| 18 | Pinang Witmas Abadi | Pinang Witmas Sejati | 10.548 | West Kalimantan | 55 | ||

| 19 | Berkat Nabati Sejahtera | IOI Corporation | 17.335 | West Kalimantan | 49 | ||

| 20 | Mitrakarya Agroindo | Sinar Mas (GAR) | 22.929 | Central Kalimantan | 46 |

Creating satellite time-lapse animations on Nusantara Atlas for companies listed in the tables above

TheTreeMap endeavours to protect tropical forests through scientific research and advanced monitoring platforms. We are cartographers, remote sensing engineers, software developers, and field investigators. We empower civil society with the tools to detect deforestation in real-time and ensure what happens on the ground is fair, transparent, and democratic. We build systems that check the deforestation footprint of agribusinesses in tropical forests to ensure sustainable production. Our work is based on the premise that no one wants food and other products to be the cause of forest destruction.